NEWS

BREAKING NEWS:U.S. Announces Sweeping Tariffs on European Goods Linked to Greenland Negotiations

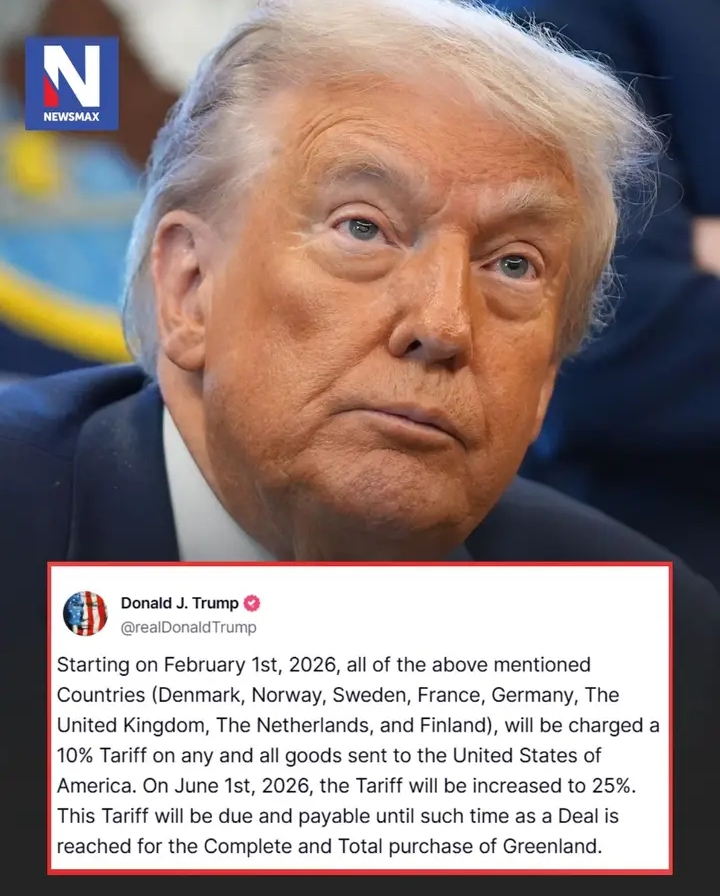

In a dramatic escalation of transatlantic trade tensions, President Donald Trump announced that the United States will impose a new round of tariffs on imports from several European countries beginning February 1.

According to the president’s statement, goods from Denmark, Germany, the United Kingdom, France, and other European nations will face a 10 percent tariff, with rates set to rise sharply to 25 percent on June 1 unless a deal is reached for the United States to purchase Greenland.

The announcement immediately sent shockwaves through global markets and diplomatic circles, reviving memories of earlier trade disputes between Washington and its traditional allies.

The proposed tariffs would affect a wide range of products, including automobiles, industrial machinery, pharmaceuticals, agricultural goods, and luxury items—sectors that are deeply integrated into U.S.–European supply chains.

At the center of the controversy is Greenland, the vast, resource-rich Arctic territory that is an autonomous region within the Kingdom of Denmark.

President Trump has previously expressed interest in acquiring Greenland, citing its strategic importance, mineral resources, and growing geopolitical significance amid Arctic ice melt and increased competition among major powers.

However, Denmark and Greenland’s leadership have consistently rejected the idea of a sale, calling the territory “not for sale” and emphasizing Greenland’ right to self-determination.

European leaders reacted with a mix of concern and disbelief.

Danish officials reportedly convened emergency consultations with European Union partners, while diplomats in Berlin, Paris, and London warned that the tariffs could trigger retaliatory measures.

EU trade officials signaled that they are reviewing potential responses under World Trade Organization rules, raising the prospect of a broader trade confrontation.

Economists cautioned that the tariffs could have far-reaching consequences for consumers and businesses on both sides of the Atlantic.

Higher import duties are likely to raise prices in the United States, particularly for cars, consumer goods, and industrial inputs, while European exporters could face reduced access to one of their largest markets.

“This risks becoming a lose-lose scenario,” said one trade analyst, noting that uncertainty alone could dampen investment and slow economic growth.

Supporters of the president’s approach argue that the move is a hard-nosed negotiating tactic designed to secure strategic advantages for the United States.

Critics, however, contend that tying trade policy to the purchase of foreign territory is unprecedented in modern diplomacy and could strain alliances at a time of heightened global instability.

With the February 1 deadline approaching, attention is now focused on whether negotiations between Washington, Copenhagen, and European partners will intensify—or whether the world is heading toward another major trade dispute with unpredictable economic and political consequences.