NEWS

BREAKING NEWS:More Money Back Where It Belongs: Trump’s Working Families Tax Cuts Deliver Bigger Refunds This Tax Season. Read more for details!

As tax season kicks off, millions of Americans are discovering something rare in Washington politics: real relief that actually shows up in their bank accounts.

Thanks to President Donald Trump’s landmark Working Families Tax Cuts Act, taxpayers across the country are poised to receive significantly larger refunds—putting more money back where it belongs, in the hands of hardworking Americans.

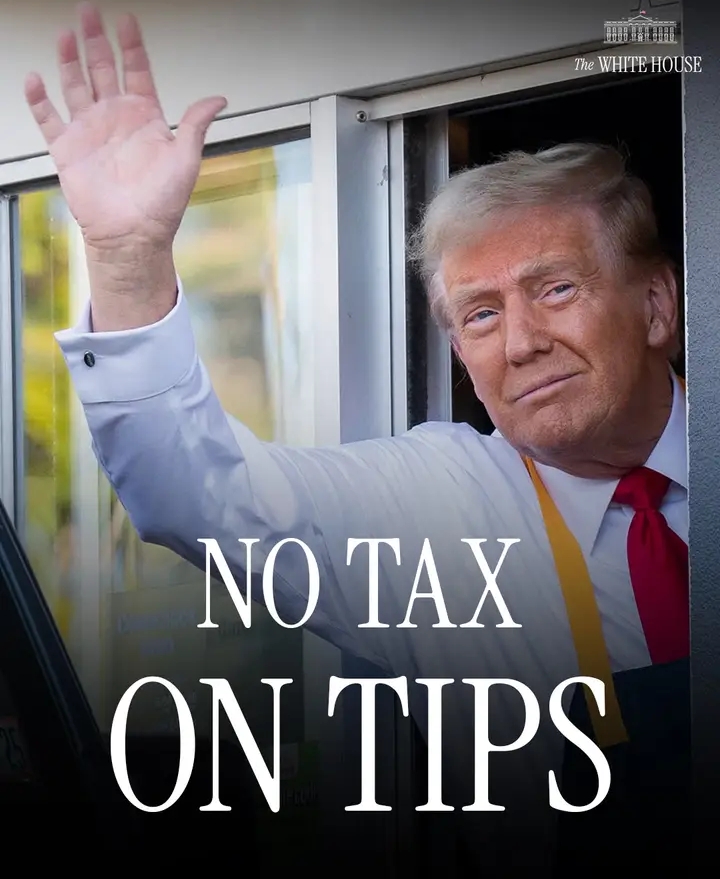

At the heart of the legislation are three bold provisions designed to reward work, not punish it: No Tax on Tips, No Tax on Overtime, and No Tax on Social Security.

Together, these reforms represent one of the most worker-focused tax overhauls in modern U.S. history.

For service industry employees—waiters, bartenders, delivery drivers, and hospitality workers—the elimination of federal taxes on tips is a game changer.

Tips are often unpredictable and already stretched thin by rising costs.

Removing taxes from that income means workers keep every dollar they earn, instantly increasing take-home pay without requiring a raise or more hours on the job.

Hourly workers and first responders are also seeing major benefits.

By ending taxes on overtime pay, the administration has ensured that extra hours worked now come with extra reward.

For families juggling inflation, rent, groceries, and childcare, that additional untaxed income can be the difference between falling behind and getting ahead.

Retirees, too, are finally getting a long-promised break.

With Social Security benefits no longer taxed, seniors living on fixed incomes can breathe easier, knowing their lifetime contributions are being respected rather than clawed back.

For many retirees, this change alone translates into thousands of dollars saved each year.

Supporters of the Working Families Tax Cuts Act argue that the policy reflects a clear economic philosophy: work more, earn more, and keep more.

Instead of expanding bureaucracy or complicated credits, the law simplifies relief and delivers it directly through paychecks and refunds.

As refund checks grow larger this year, the impact of the legislation is becoming tangible.

From kitchen tables to retirement communities, Americans are feeling the effects of a tax system recalibrated in their favor.

In an era of economic uncertainty, one thing is clear this tax season: for millions of Americans, the numbers finally add up—and they’re keeping more of what they earn. 💰🇺🇸