NEWS

Breaking News:Trump Moves to Restrict Big Investors From Buying U.S. Homes.

President says corporate ownership is pricing Americans out of housing.

January 8, 2026 | WASHINGTON.

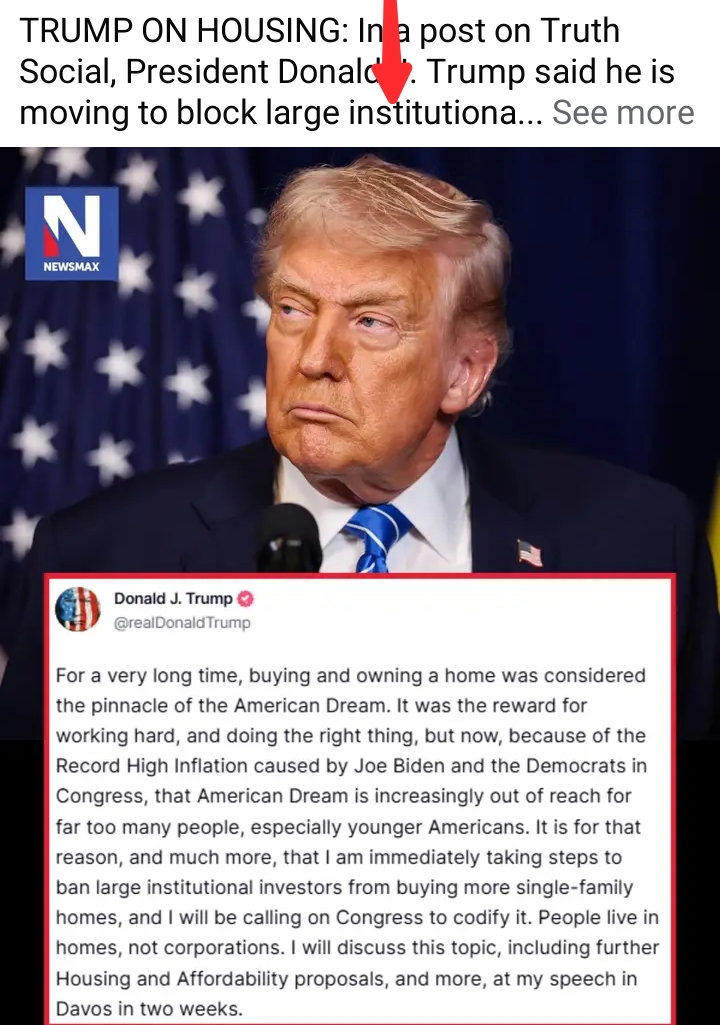

President Donald J. Trump announced this week that his administration is taking action to block large institutional investors from purchasing single-family homes, a policy he says will make housing more affordable for ordinary Americans.

The announcement was made in a post on his social platform, Truth Social, and comes amid ongoing concerns about housing affordability and market access for first-time buyers.

In his post, Trump framed the initiative as part of his broader effort to protect the American Dream of homeownership, writing that “people live in homes, not corporations.”

He argued that corporate and institutional ownership of single-family residences has contributed to rising prices, making it harder for young families and first-time buyers to compete in the housing market.

Trump also blamed record inflation under the Biden administration and Democratic Congress** for worsening the affordability squeeze.

What the Proposal Would Do.

Under the plan, the federal government would move to ban large institutional investors — such as private equity firms, real estate investment trusts (REITs), and major Wall Street buyers — from acquiring additional single-family homes.

Trump said he is “immediately taking steps” and plans to press Congress to codify the measure into law.

Specific implementation details were not released, and it remains unclear how the policy would be enforced or what legal authority the administration would rely on without Congressional authorization.

Market Reaction and Broader Impact

Financial markets responded quickly to the announcement, with share prices of major real estate and investment firms — including Blackstone and Invitation Homes — tumbling in midday trading.

Some homebuilder and mortgage-related stocks also saw declines.

Analysts and housing advocates offered mixed assessments of the plan:

Supporters argue that curbing corporate purchase activity could help slow price increases in competitive markets and free up inventory for individual buyers.

Critics note that institutional investors currently own a small share of the overall single-family housing stock nationally (often cited around 1–2%), though their presence is much higher in specific metropolitan areas, such as Atlanta, Jacksonville, and Charlotte.

They also point out that a lack of housing supply and high mortgage rates remain core challenges to affordability.

Economists have warned that limiting investor activity alone may not significantly relieve the nationwide housing shortage without accompanying measures to increase construction and address other structural issues.

Political Context.

Trump’s announcement arrives as housing affordability continues to be a central concern for American voters, particularly younger families aiming to buy their first homes. He said he plans to outline additional housing and affordability proposals at the World Economic Forum in Davos later this month.

Lawmakers from both parties have occasionally proposed restrictions on corporate home buying in recent years, reflecting bipartisan frustration with rent and price pressures.

Whether Trump’s proposal will attract significant legislative support remains to be seen.